TOPSAIL PERSONALIZED INDEXING

Using the most advanced personalized indexing technology,

Tax Efficient

Tax optimized to minimize tax liabilities and to add potential tax alpha. Owning the individual securities allows for tax-loss harvesting (TLH) within the index.

Customized Diversification

Personalized indexing lets us build around and diversify your current positions and legacy portfolio. Minimizing the cost of diversification.

Tailored Flexibility

With the capability to be customized according to your preferences or desired investment factors.

What is personalized indexing?

-

Your separately managed account is based on the diversification needs of your portfolio.

-

Your SMA is managed to your personal objectives and you are not impacted by other investors.

What can Topsail Personalized Indexing do for you?

-

Potentially boost your after-tax returns through tax optimization and active tax-loss harvesting.

-

Customized portfolios that reflect your portfolio’s diversification needs, values, objectives, and tax situation.

-

Offer you a sophisticated personal indexing strategy and construction powered by Vanguard or Schwab.

How does personalized indexing work?

Separately managed accounts have been used by high-net-worth families for years, and can have numerous benefits:

-

Transparency and direct ownership of each security—you know and own what’s in your portfolio

-

Tax efficiency—you gain the potential to increase your after-tax returns.

-

Personalized indexing with daily tax-loss harvesting has been shown to increase ultra-high-net-worth investors’ after-tax returns by 1%–2%1

-

Fully customizable—you can build a portfolio that reflects your preferences, values, and outlook

-

Easily adaptable—we’ll build a diversified personalized index around large existing stock holdings or incorporate specific market views

[1] Kevin Khang, Alan Cummings, Thomas Paradise, and Brennan O’Connor, 2022. Personalized indexing: A portfolio construction plan. Valley Forge, Pa.: The Vanguard Group.

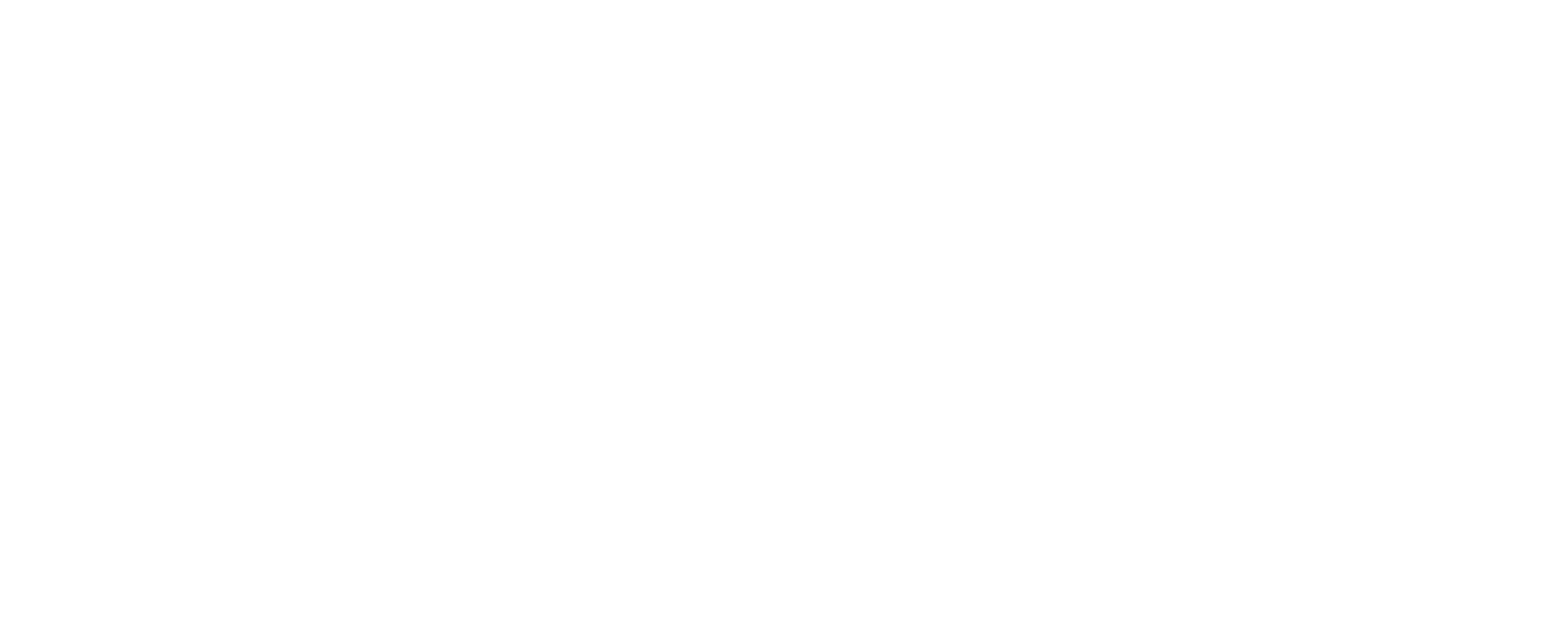

Personalized indexing with tax-loss harvesting works to offset capital gains

Note: This is a hypothetical illustration and is not representative of an actual portfolio.

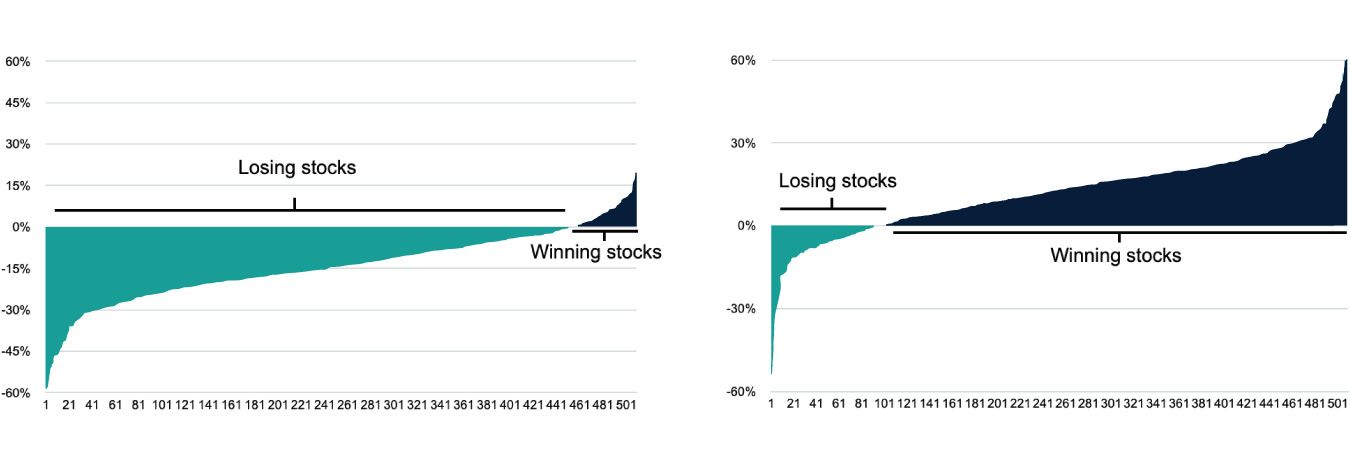

Improve tax-loss harvesting opportunities

Whether the return of your benchmark index rises or falls, there will be individual stocks in the index that present tax-loss harvesting opportunities, which can potentially improve your after-tax returns.

Source: FactSet, as of January 31, 2023. Index performance shown may not be a typical representation due to volatility during this period. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

ETFs compared to Personalized Indexing

CONTACT

Here at Topsail Wealth Management, we pride ourselves on being available to

our clients in every situation. Contact us with any questions, comments, or

concerns that you may have.

[1] Kevin Khang, Alan Cummings, Thomas Paradise, and Brennan O’Connor, 2022. Personalized indexing: A portfolio construction plan. Valley Forge, Pa.: The Vanguard Group. Simulation as of September 2021.

This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice.

Neither the tax-loss harvesting strategy nor any discussion herein is intended as tax advice and does not represent that any particular tax consequences will be obtained. Tax-loss harvesting involves certain risks including unintended tax implications. Investors should consult with their tax advisors and refer to Internal Revenue Service (“IRS”) website at www.irs.gov about the consequences of tax-loss harvesting.

Diversification and asset allocation strategies do not ensure a profit and cannot protect against losses in a declining market.

There are risks associated with any investment approach, and each indexing strategy and equity market segment has their own set of risks based on client strategy selection and further customization.

Vanguard Personalized Indexing Management, LLC (“Vanguard Personalized Indexing Management”) or Vanguard Personalized Indexing Management, LLC (“Vanguard Personalized Indexing Management”), formerly Just Invest, LLC, an SEC registered investment adviser, is an independently operated wholly-owned subsidiary of The Vanguard Group, Inc. (“Vanguard”). Vanguard Personalized Indexing is an asset management technology that has been developed and is offered solely by Vanguard Personalized Indexing Management. For more information on Vanguard Personalized Indexing Management and Vanguard Personalized Indexing, and to access Vanguard Personalized Indexing Management’s Form CRS and Form ADV Part 2A disclosure brochure, please visit Vanguard Personalized Indexing page.

Schwab Personalized Indexing™ is provided by Charles Schwab Investment Management, Inc., dba Schwab Asset Management, a registered investment adviser and an affiliate of Charles Schwab & Co., Inc. (“Schwab”). Both Schwab Asset Management and Schwab are separate entities and subsidiaries of The Charles Schwab Corporation.

Portfolio Management for Schwab Personalized Indexing™ is provided by Charles Schwab Investment Management, Inc., dba Schwab Asset Management, a registered investment adviser and an affiliate of Charles Schwab & Co., Inc. (“Schwab”). Both Schwab Asset Management and Schwab are separate entities and subsidiaries of The Charles Schwab Corporation.

Please refer to the Charles Schwab Investment Management, Inc. Disclosure Brochure for additional information.

By building a partnership based on mutual trust, our ultimate goal is to provide you with the best possible investment management and continue to add value to you and your family.